Taiwan

Taiwan

Last updated: January 2024

Taiwan’s high-quality human capital and physical and technological infrastructure support a higher ranking on business climate indicators and stronger economic growth prospects relative to other advanced economies. Creditworthiness is high but lower than that of other advanced economies. Although Taiwan has high GDP per capita, incomes significantly lag the average of advanced economies.

This chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2024 and 2028. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other regional countries.

Economic outlook

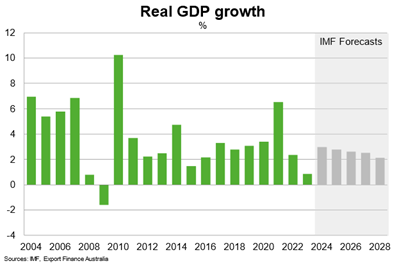

Taiwan’s real GDP growth slowed to 0.8% in 2023 from 2.4% in 2022, in large part as exports fell due to lower global demand for electronics. High inflation, high interest rates, economic uncertainty and a build-up of chip stockpiles all contributed to lower manufacturing output. Furthermore, weak domestic consumer confidence and subdued wage growth weighed on household spending.

The worst of the downturn in Taiwan’s exports may have passed, as exports resumed year-on-year growth in November 2023. This offers positive signs for the export-manufacturing economy in 2024. The IMF forecasts growth to pick up to 3% in 2024, supported by Taiwan’s key strengths—high levels of per capita income, high-quality human capital and physical and technological infrastructure, and a commanding position in the semiconductor supply chain. Demand for Taiwan’s technology-intensive integrated circuit chips benefit from growing digitisation, 5G network deployment, high-performance computing, electronic vehicles, industrial automation and artificial intelligence. In addition, prospects for lower interest rates in 2024 should support recovery in business and consumer spending.

In presidential and legislative elections in mid-January, Lai Ching-te of the Democratic Progressive Party (DPP) won the presidency. Despite securing the presidency for an unprecedented third consecutive term, the DPP lost its parliamentary majority in the Legislative Yuan. A fragmented parliament could hinder implementation of DPP economic policies, including the phasing-out of nuclear power by 2025 and proposed expansions to government spending. Existing economic barriers between China and Taiwan in bilateral investment, travel and trade are likely to persist, with the potential for further restrictions.

Risks are significant and tilted to the downside. The potential for worsening geopolitical tensions could see technology companies relocate manufacturing bases outside of Taiwan. Global macroeconomic headwinds generate uncertainty about the export outlook. Ongoing property-sector challenges in China could further hinder demand for electronics.

The IMF expects growth to average 2.5% per annum between 2025 to 2028. Stable international trade and cross-strait relations are key to Taiwan’s economic performance over the longer term. Continued access to customers and suppliers from China and the US remains critical for Taiwan’s export-oriented manufacturers to maintain external competitiveness and productivity. Taiwan’s dominance in high-tech exports should continue to attract large capital investments over the longer term.

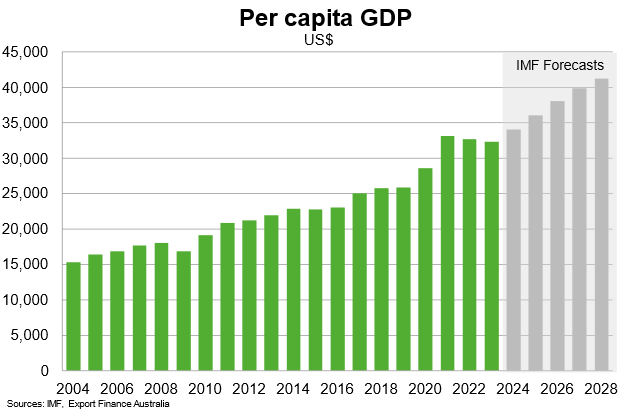

Alongside faster economic growth, per capita incomes are projected to increase towards US$41,000 in 2028 according to IMF forecasts, up from around US$32,000 in 2023. That will arrest a downward trend in 2022 and 2023, which reflected sluggish GDP growth.

Country risk

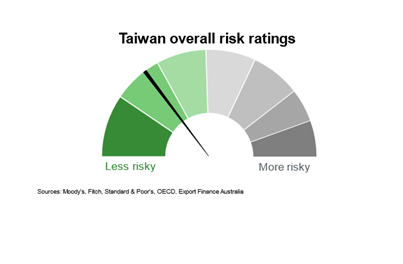

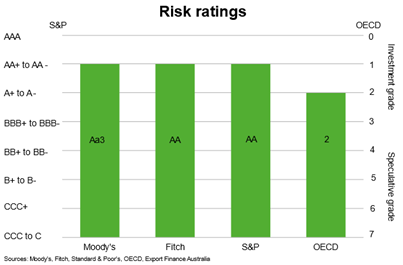

Country risk in Taiwan is low to moderate. Taiwan has an OECD country credit grade of 2 and investment grade sovereign credit ratings from private ratings agencies. This indicates a relatively low likelihood that Taiwan will be unable or unwilling to meet its external debt obligations.

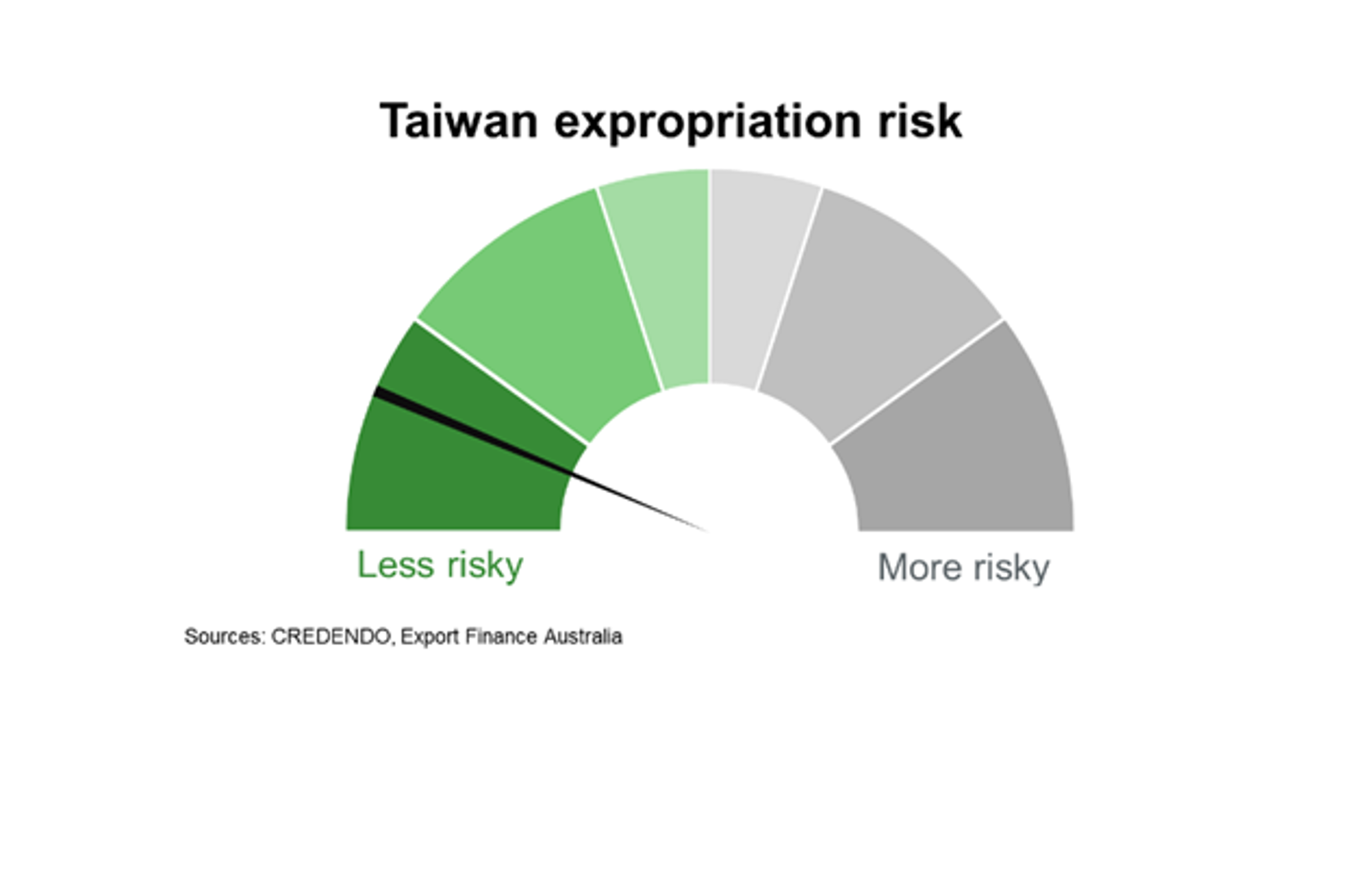

The risk of expropriation in Taiwan is low. According to the US investment climate statements, under Taiwanese law, the authorities may expropriate property whenever it is deemed necessary for the public interest, such as for national defence, public works and urban renewal projects. Taiwan law requires fair compensation must be paid within a reasonable period when the authorities expropriate constitutionally protected private property for public use.

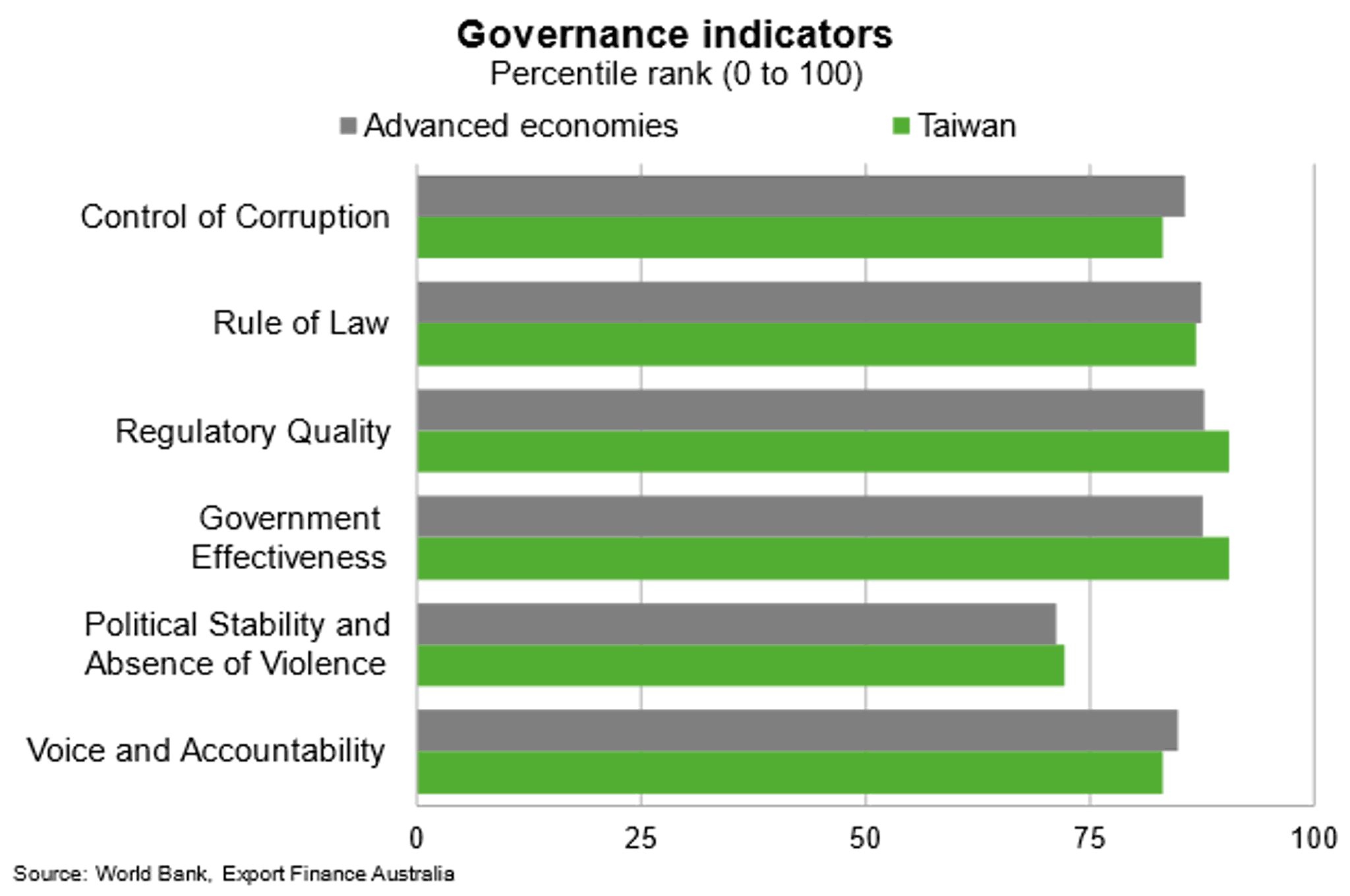

Taiwan scores in the top quartile in most areas of governance, and higher than other advanced economy peers. Broadly stable economic outcomes despite elevated geopolitical tensions and gyrations in the global economy highlights Taiwan’s strong governance and institutions. Beyond the 2024 election, the Democratic Progressive Party’s lack of a parliamentary majority in the Legislative Yuan could hinder the implementation and effectiveness of government policies.

Taiwan’s political risk is on par with its overall rating. Political risk relates to the potential for further escalation in geopolitical tensions that adds to trade and growth risks. Taiwan scores slightly lower than advanced economy peers on measures of political stability and absence of violence.

Bilateral relations

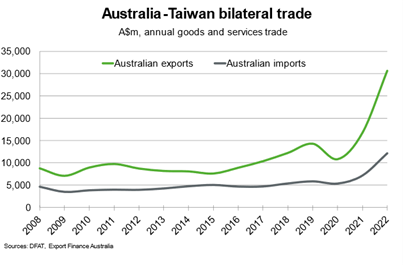

Taiwan is Australia’s seventh largest trading partner. Total goods and services trade amounted to around $43 billion in 2022, up from $24 billion in 2021. Resources and energy—coal, natural gas, iron ores, copper and aluminium—are the chief goods exports. Education-related exports are also significant. Major Taiwanese goods imports to Australia include refined petroleum, telecommunication equipment and parts, motorcycles and cycles, tobacco and computers. The recent sharp widening of Australia’s trade surplus with Taiwan can be attributed to a rise in Australian energy exports, particularly coal and natural gas. This reflected both higher energy prices and Taiwan’s efforts to diversify energy imports.

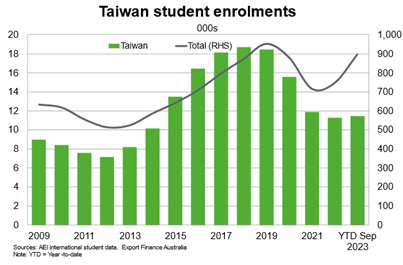

Taiwan is Australia’s 18th largest source of student enrolments. Taiwanese student enrolments had been gradually rising before the pandemic, before falling sharply in 2020 and stalling in the past few years. Taiwan’s drive to up-skill its labour force creates opportunities for Australian education exports in the future.

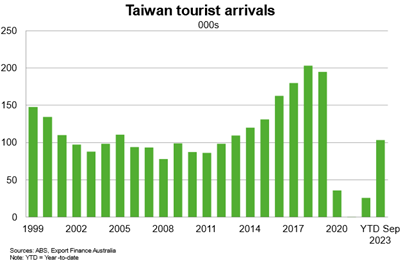

Before the pandemic, Taiwan was Australia’s 13th largest source of tourism. Taiwan’s international borders for outbound tourism opened in September 2022, limiting the recovery in tourism in 2021 and 2022. Recovery in visitor arrivals has been evident in 2023, but they remain well below pre-pandemic levels. A competitive Australian dollar and another year of recovery in international travel should support further demand for Australian tourism, and broader services exports, in 2024.

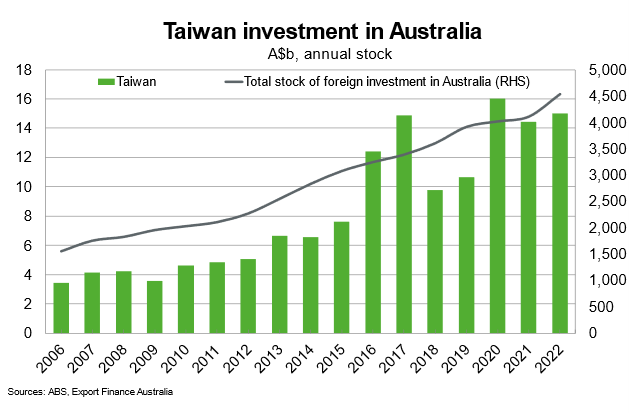

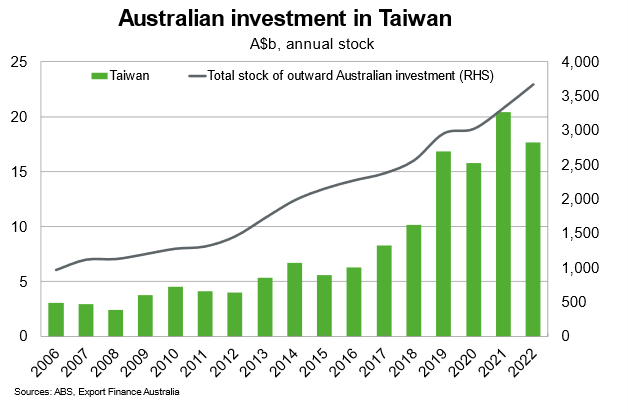

Australia’s stock of investment in Taiwan was $17.6 billion in 2022, down 13.5% from 2021, but double the levels of 2017. The rise in Australian investment over the past five years reflects growing trade and investment as part of Taiwan’s New Southbound Policy and growth in advanced technology and energy sector development.

Taiwan’s stock of investment in Australia climbed to $15 billion in 2022. Taiwanese investment in Australia is typically in minerals and resources but has expanded to include biomedicine, renewable energy, energy storage, tourism infrastructure, food and financial services. Looking ahead, global energy transition policies create opportunities for Australian and Taiwanese investment in renewable energy sources.