Economic outlook

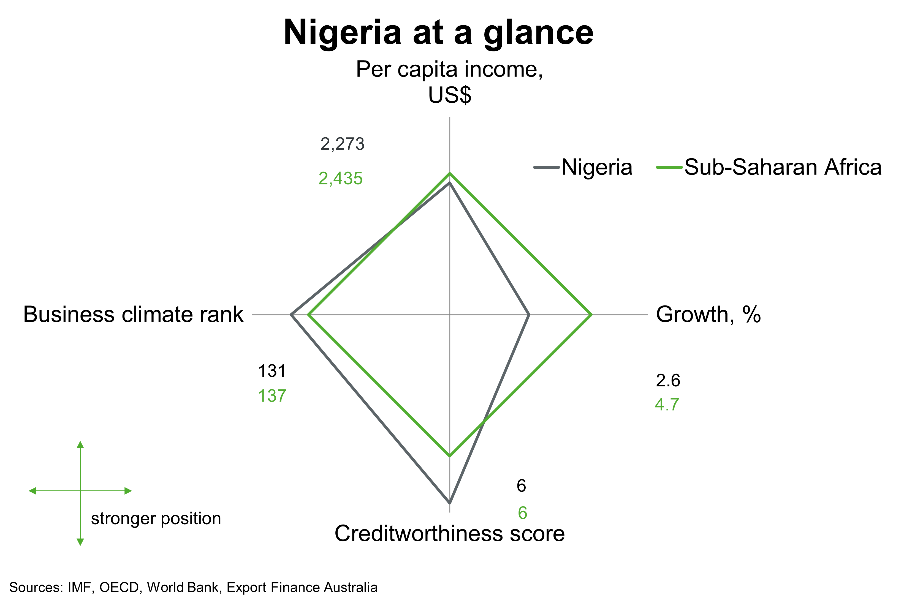

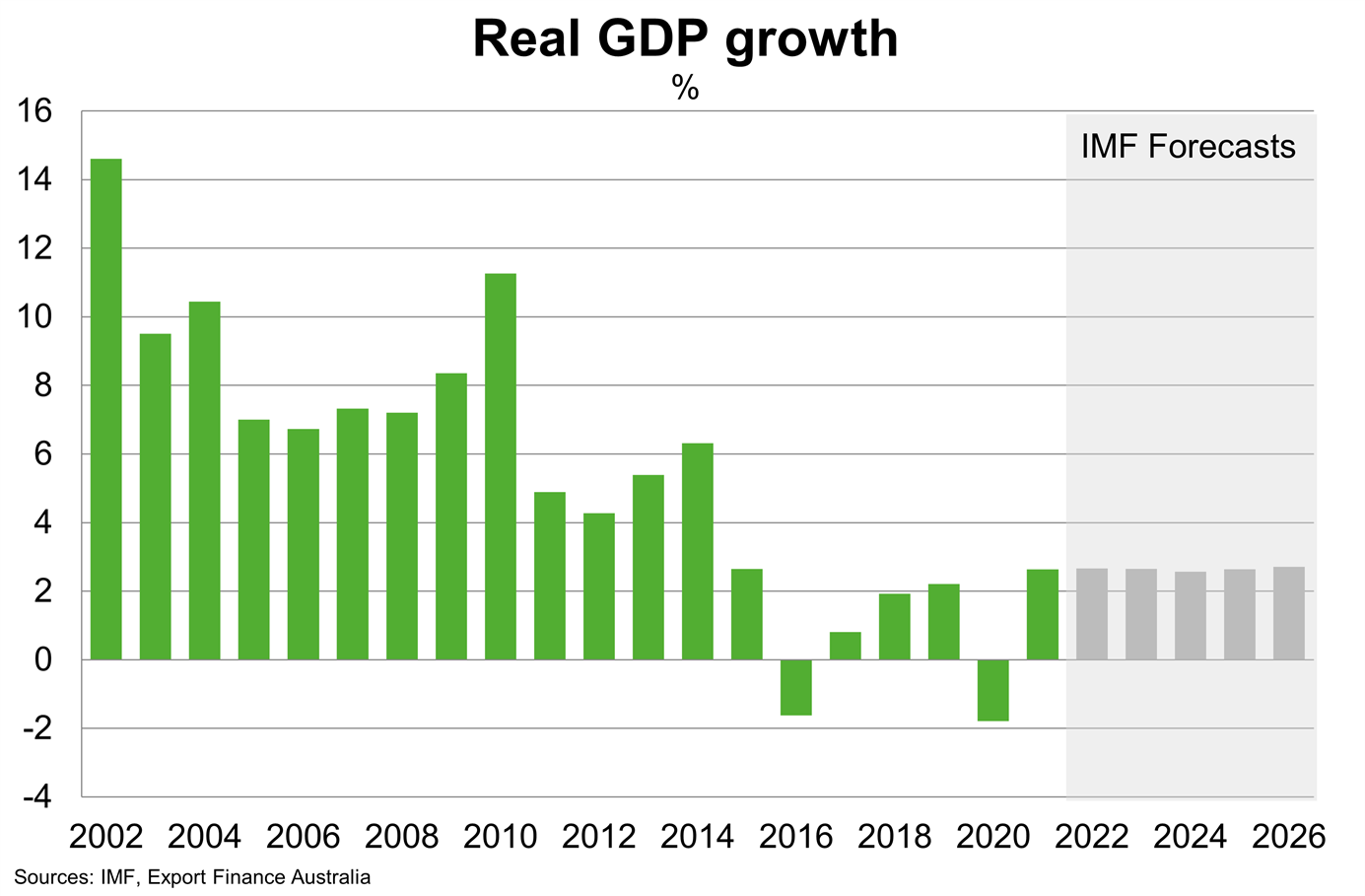

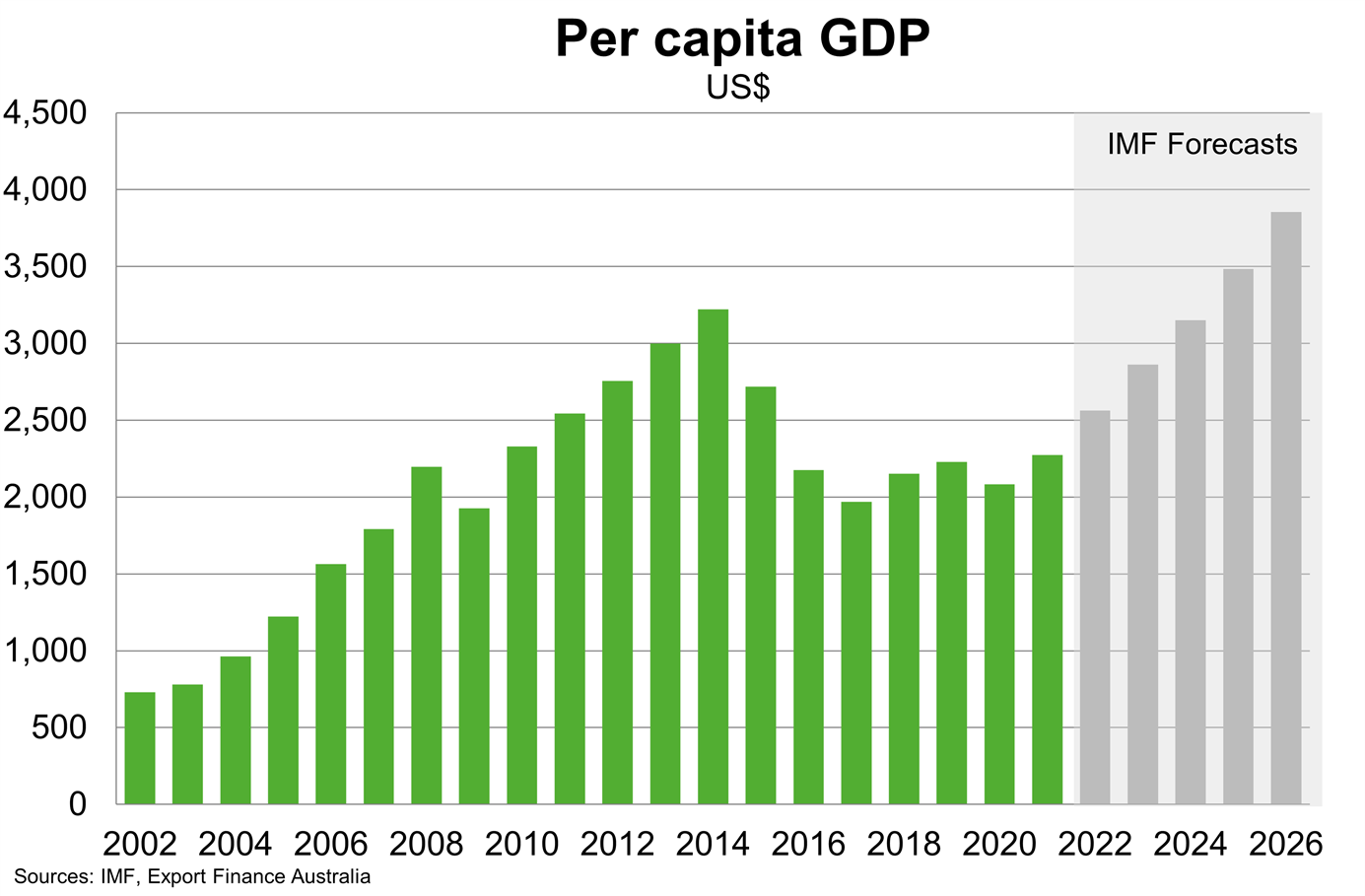

After the dual shocks of COVID-19 and lower oil prices in 2020, recovery in crude oil prices and production helped Nigeria’s economy grow 2.6% in 2021. Oil makes up over 80% of Nigerian exports, a third of banking sector credit and half of all government revenues.

The IMF estimates that growth will average about 2.5% per annum through to 2026. Growth will be supported by higher oil prices and financial support from International Financial Institutions, such as the IMF, that will improve US dollar liquidity. The recent adoption of the Petroleum Industry Act has reduced uncertainties that, over more than a decade, significantly weighed on investment in the Nigerian oil and gas sector. Over the next few years, other sectors including agriculture and services are also likely to be supported by increasing government support and improved US dollar liquidity. The government is also attempting to diversify its economy through implementation of the Nigeria Economic Sustainability Plan, which includes a commitment to deliver 5 million new solar connections and a reduction in fossil fuel subsidies.

Over the medium term, growth prospects remain dependent on oil prices and trends in decarbonisation. Key challenges to economic development include insufficient infrastructure, high unemployment, poverty and growing inequality. Although growth prospects are higher than pre-pandemic levels, they remain weaker than before the 2016 oil price shock, contributing to ongoing challenges around economic and social development. Nigeria is expected to be the second most populous country in the world by 2100 according to World Bank projections. This, alongside its youthful population, presents potential opportunities arising from increased demand for consumption and services.