Brazil

Brazil

Last updated: January 2024

Brazil is the world’s 9th largest economy, and the largest in Latin America. Brazil has significant resources wealth, including gold, uranium, iron, and timber, and is the world’s largest producer of coffee. Per capita incomes and economic growth prospects are weaker than the average for Latin American countries. Creditworthiness is stronger than the regional average while the business climate slightly lags.

The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2024 and 2028. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region.

Economic Outlook

he Brazilian economy grew at a solid 3.1% in 2023, remaining resilient to global headwinds. Household consumption rose on the back of a 4.6% increase in inflation-adjusted wages in the year to August 2023; attributed to minimum wage hikes and easing inflation pressures (inflation fell to 4.6% year-on-year in December 2023 amid high interest rates). Export growth remained robust thanks to a strong soybean crop in 2023 and continued strength in mining exports. Monetary policy has begun to ease, as interest rates have fallen from 13.75% in August to 11.75% in December 2023.

The IMF predicts growth to slow to 1.5% in 2024. Household consumption, the main driver of growth, is expected to moderate in 2024 as the boost from lower food prices and higher government spending fades. Household debt remains high, pointing to a pullback in discretionary borrowing. On the other hand, continued easing in interest rates should boost investment. Furthermore, recent strength in agricultural exports, particularly of soybeans, could continue in 2024, if US production falls and demand from China grows. In general, Brazil’s diverse commodity base provides strong prospects for continued economic growth ahead.

Risks to the outlook are balanced. Commodity prices are vulnerable to global developments. Slower than expected growth in China could significantly hurt exports. Climate change risks persist and could take a larger toll on the exports sector; for example the Amazon drought has disrupted shipments from Brazil.

Longer term, the IMF estimates GDP growth of 2% per annum, on average, between 2025 and 2028. The implementation of a new fiscal framework aimed at reducing public debt risks supports long term growth. This framework includes annual budget targets over the medium to long term; limiting fiscal deficits to 0.5% of GDP from 2023-25 and 1% of GDP in 2026. High public debt of around 74% of GDP in November 2023 limits prospects for government investment. Similarly, the planned adoption of a unified value-added tax will simplify goods and services tax while reducing the administrative burdens for businesses. Strong trade relations between Brazil and China should put a floor under exports. But chronic structural constraints still exist, such as low productivity growth and income inequality.

Per capita income rose above US$10,000 in 2023, recovering to 2017 levels. Despite little change in poverty rates between 2014 and 2022, rising minimum wages and the planned introduction of additional benefits for families with children should help improve living standards and reduce poverty rates moving forward. The IMF forecasts GDP per capita to grow by an average of about 5% per annum between 2024 and 2028, supported growth in GDP and wages.

Country Risk

Country risk in Brazil is moderate. The OECD rating is 4, indicating a moderate probability the country may be unable or unwilling to meet its external debt obligations. The rating was upgraded from 5 in 2023, supported by solid economic growth, higher commodity prices for key exports and progress on structural reforms to lift private sector activity.

Brazil has a low to moderate risk of expropriation, as no major expropriation actions have taken place against foreign investors in recent years. According to the US Investment Climate Statements, the government can, however, expropriate private property for public use, including national security, public transportation, safety, health and urbanisation projects. In such cases, owners are compensated at fair market value.

Brazil’s governance indicators are largely in line with the Latin American average, except for lower scores on political stability/absence of violence, government effectiveness and control of corruption. Ongoing implementation of reforms aim to help address these gaps in governance.

Political and social risks are moderate. President Luiz Inacio Lula da Silva’s economic policies are focused on boosting business and investors’ confidence, increasing social spending plans, creating greater shared prosperity and reversing the strain on public finances. The threat of protests remains an ever-present risk.

Bilateral Relations

Brazil was Australia’s 27th largest trading partner in 2022, and largest export market in Latin America by a significant margin. Total goods and services trade amounted to $5 billion in 2022, a 36.5% increase from 2021 due to an increase in exports. Major Australian exports included coal (around 75% of exports to Brazil in 2022), education-related travel, fertilisers and aluminium. Major Australian imports from Brazil in 2022 included civil engineering equipment and parts, coffee, medicine, and pulp and wastepaper. The recent sharp widening of Australia’s trade surplus with Brazil can be attributed to a rise in Australian energy exports, particularly coal. This reflected higher energy prices and rising imports due to European Union restrictions on Russian energy supplies.

Brazilian student enrolments have picked up as pandemic restrictions have eased, but remain lower than their peak of about 40,000 in 2019. Despite lower enrolments, Brazil remained the 9th largest source of international students in Australia through 2023. To promote enrolments in Australian universities moving forward, Australia’s top eight universities (Group of 8) have agreements with universities and research organisations in Brazil.

Tourism arrivals continued their recovery in 2023, after COVID-19 pandemic and associated international travel restrictions hurt tourism significantly in 2020 and 2021. Still, Brazilian tourism arrivals in Australia remain below pre-pandemic levels. A competitive Australian dollar and another year of recovery in international travel should support further demand for Australian tourism, and broader services exports, in 2024.

Most of Australia’s foreign direct investment in Latin America goes to Brazil (about $10.5 billion in 2022, or 0.3% of total Australian outward investment). More than 75 Australian companies operate in Brazil in a wide range of sectors, including advanced manufacturing (Amcor), infrastructure (Macquarie), engineering services (Worley), financial services (Macquarie), mining (BHP Billiton), plasma products and vaccines (CSL), and retail clothing (Cotton On, Billabong, Rip Curl), among others.

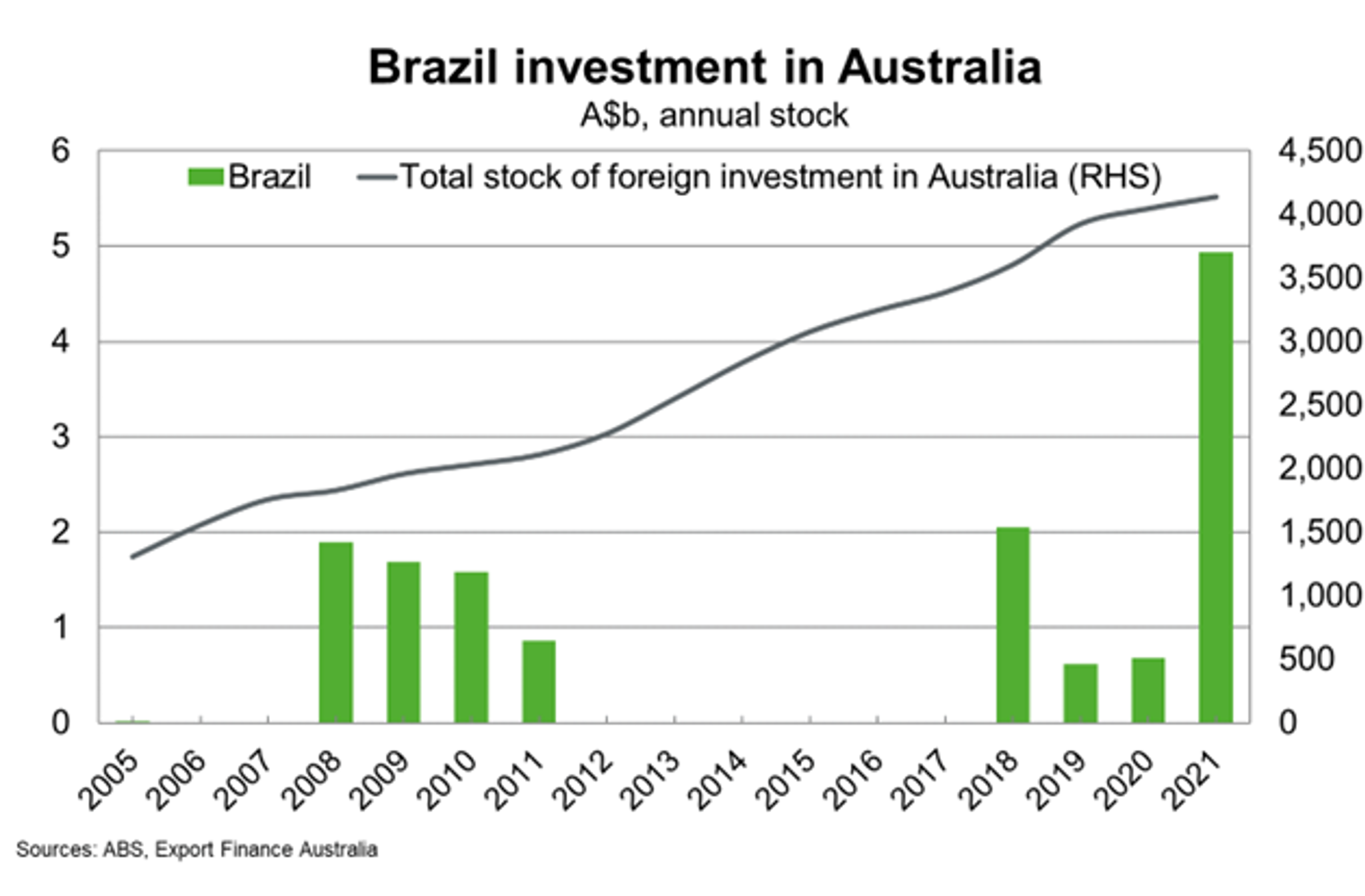

Brazil’s growing infrastructure needs, and large mining and agricultural industries present investment opportunities for Australian firms in Brazil. Opportunities exist in sectors such as transportation, mining in critical minerals, financial services and waste management. Investment has, and will continue to be supported by a Memorandum of Understanding between the two countries that supports promotion and identification of investment opportunities. By contrast, Brazilian investment in Australia is smaller.

Brazilian companies continue to expand operations and invest in Australia, in part to benefit from Australia’s extensive free-trade network in Asia. For example, Minerva Foods and JBS Foods are two Brazilian meat processing companies increasing investment in manufacturing processes and facilities in Western Australia and Queensland. Continued deregulation in Brazil provides opportunities for Australian exporters of financial, agricultural, and medical technologies.

Useful Links

Department of Foreign Affairs and Trade

Austrade