Economic outlook

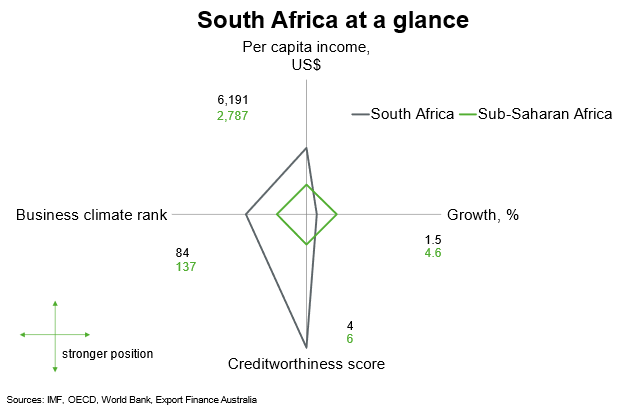

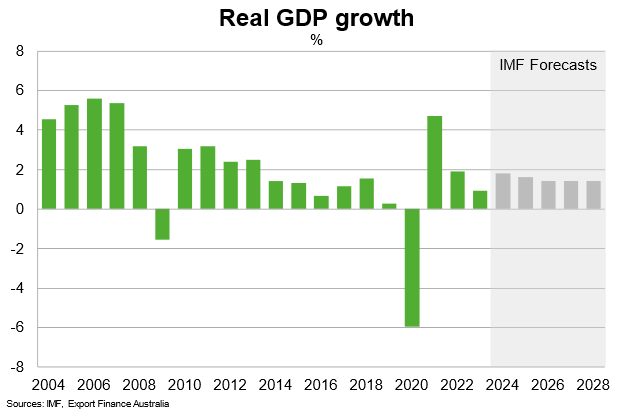

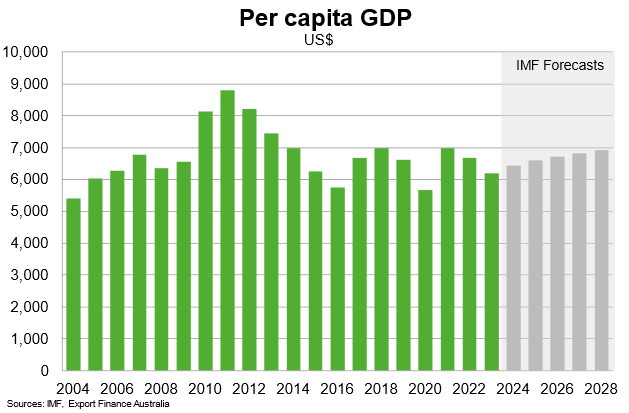

Real GDP grew by 0.9% in 2023, slower than 1.9% in 2022. Growth weakened as a result of subdued household expenditure and business confidence on the back of high interest rates, cost of living pressures, high household debt and policy uncertainty. Challenges in the manufacturing and mining sector remained persistent due to electricity supply shortages, weaker freight and logistics capacity and ailing infrastructure. Sluggish economic growth continues to weigh on the labour market; the unemployment rate remained very high at 32.6% in the second quarter of 2023.

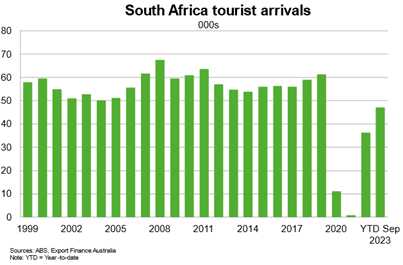

The IMF expects growth to accelerate to 1.8% in 2024, helped by greater investment in energy generation that helps alleviate pressure on cuts to power supply. Further recovery in international travel is likely to boost demand for South African tourism. On the downside, exports are likely to remain weak amid slow global demand. Private consumption is similarly likely to remain constrained because of still-high inflation. Amid elevated public debt, fiscal consolidation will remain a key priority for the government, limiting public consumption and investment.

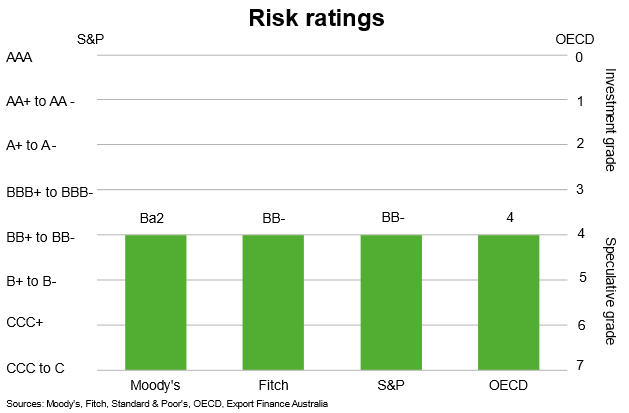

Risks to the outlook include prolonged electricity shortages, subdued global economic activity and persistent high inflation that could result in further tightening of monetary policy. Dry weather conditions may also hurt crop yields and raise domestic food inflation. High public debt leaves South Africa vulnerable to economic and climate shocks.

South Africa’s young population and location bode well for the long-term outlook. South Africa has better infrastructure than most other African countries. Moreover, the government has advanced several reforms, including to combat corruption, promote medium-term growth and consolidate public finances. But long-standing economic and financial constraints, including large external imbalances, high public debt, intermittent energy supply, elevated social tensions and heavy reliance on commodities are all likely to keep growth below 2% per annum in the medium term.