Economic outlook

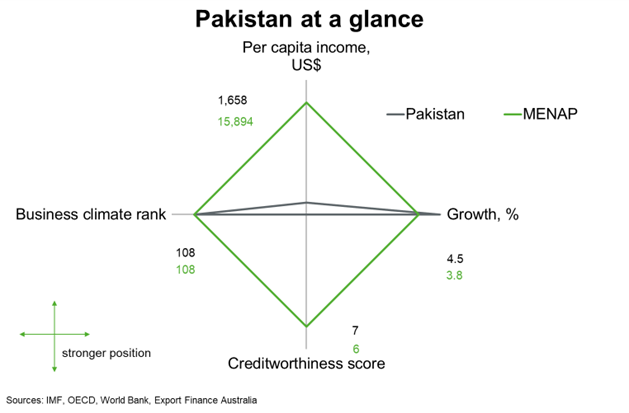

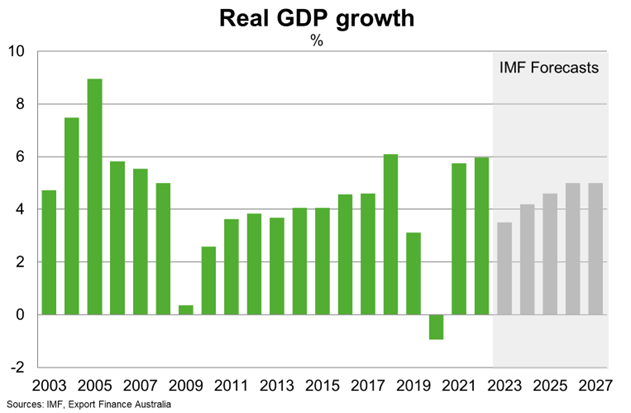

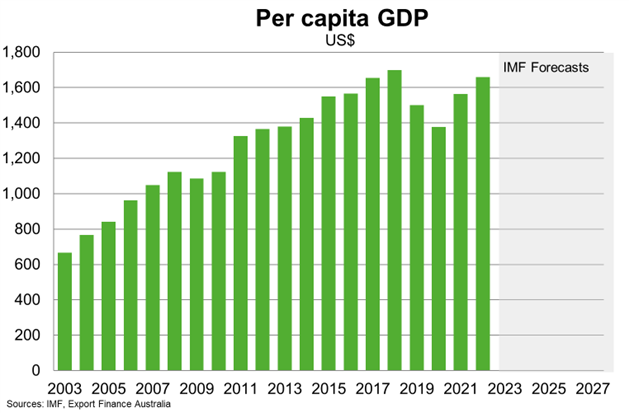

Pakistan’s economy expanded by 6% in 2022 on the back of strong domestic demand linked to accommodative fiscal and monetary policies. Rising output from agriculture, services, and large-scale manufacturing supported growth.

The IMF expects growth to slow to 3.5% in 2023. The damage caused by devastating floods will hurt agricultural production in 2023 and the global slowdown will weigh on exports. Fiscal tightening and rising interest rates, driven by IMF-led reforms that have been extended through to June 2023 to consolidate public finances and curb high inflation, will suppress domestic demand. Public spending for relief, recovery, and rehabilitation efforts from the floods will provide support to growtheconomic activity this year.

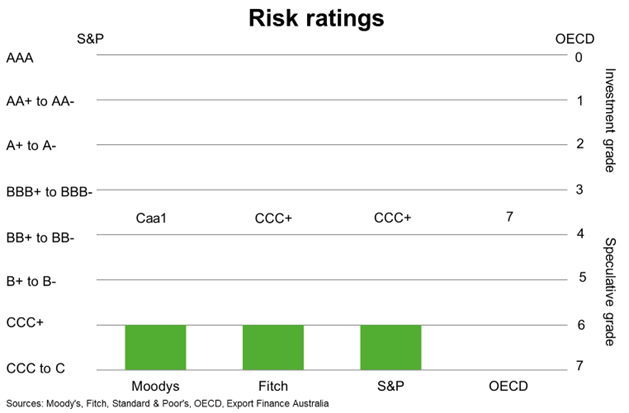

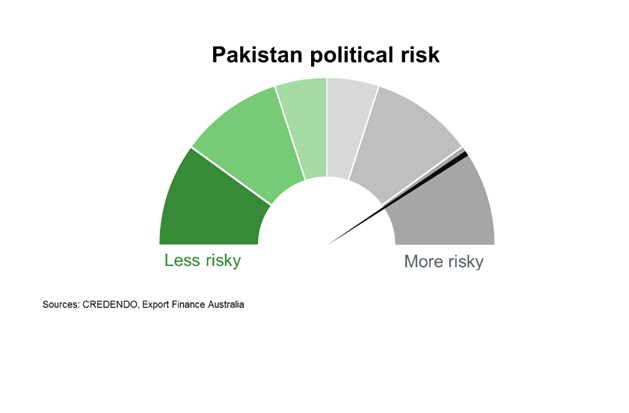

Longer term, infrastructure investments through projects in the China-Pakistan Economic Corridor (CPEC) and significant increases in power supply can help address some of Pakistan's economic constraints and strengthen its growth potential. Pakistan's young and growing population presents both opportunities and challenges. Structural reforms in Pakistan’s IMF Extended Fund Facility program are important to support economic growth and financial resilience ahead. The IMF projects real GDP to expand between 4% to 5% per year, on average, from 2024-27. Such forecasts would be at risk if there is insufficient progress on IMF reforms. Downside risks also stem from high debt constraining government spending and further instability in the political and security environment. Additional risks to growth include vulnerability to another natural disaster, a worsening external position (reflecting higher global commodity prices and interest rates), and large domestic and external financing needs.