China—Policy support to boost a sharply slowing economy

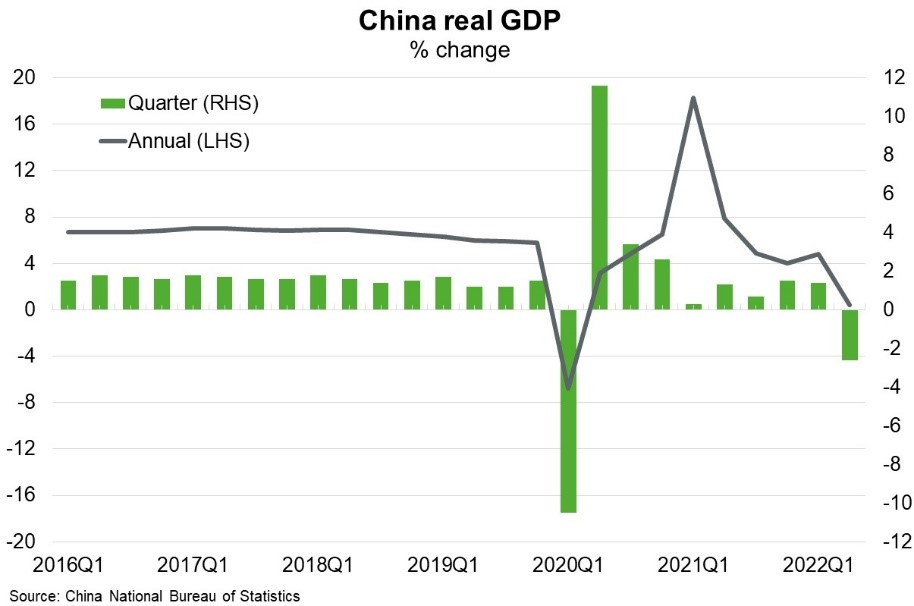

Real GDP growth slowed sharply to 0.4% year-on-year in Q2, after a 4.8% expansion in Q1, amid China’s worst COVID outbreak since the onset of the pandemic (Chart). On a quarter-on-quarter basis, GDP fell 2.6% in Q2. China’s 2022 GDP growth target of around 5.5% now looks increasingly out of reach. Monthly data indicated signs of more normal business activity in June, after the government eased lockdown restrictions in Shanghai and Beijing, though consumption data remained weak.

Authorities remain committed to eliminating COVID, and some parts of China have reinstated restrictions as cases spike again. According to Nomura, regions that account for about 19% of China’s GDP are currently under some form of restriction. This will fuel global supply chain disruptions, which are affecting more than two-in-five Australian businesses. Meanwhile, the weak property market and slowing global economy threaten production and exports.

In response, authorities have signalled a government funded infrastructure push of CNY7.2 trillion (US$1.1 trillion, about 6% of China’s GDP), though Premier Li Keqiang has since stated China will not use “super large” scale stimulus to meet growth targets. China’s central bank is also maintaining ample liquidity in the banking system and kept interest rates unchanged for a sixth straight month in June. As advanced economies continue to raise interest rates, Chinese monetary policy will be limited as interest rate differentials put pressure on capital outflows. The V‑shaped recovery seen in 2020 is unlikely to be repeated.

Continued fiscal and monetary support, particularly concentrated in infrastructure, should buffer any easing in demand for, and prices of, commodities, such as iron ore, coal and copper. That will benefit Australia’s already strong resources and energy exports; that helped drive a record trade surplus of almost $16 billion in May. Australia’s merchandise export outlook remains bright; resources and energy exports are forecast to rise to $419 billion in 2022–23, after an estimated $405 billion in 2021–22, delivering two successive record years of earnings, while agricultural exports are also poised to reach a record high in the next 12 months.