Advanced Economies—Declining real wages erode consumer spending

Inflation is currently above central bank targets in most advanced economies, particularly outside Asia. Median inflation in advanced economies climbed to 6.9% in April, the highest level since 1982. While rapid increases in food and energy prices have been a major driver, recent data show the price acceleration broadening across consumption baskets. The OECD expects inflation to moderate next year, provided that the peak in global energy prices is passed in early 2023 and supply chain constraints gradually wane. Even so, inflation is now seen as staying higher for longer in most OECD economies, despite rapid monetary tightening. In particular, the US Federal Reserve raised rates by three-quarters of a percentage point this month, the largest hike since 1994. Federal Reserve Board members expect the Federal funds rate will end the year at 3.4%, an upward revision of 1.5 percentage points from the March estimate.

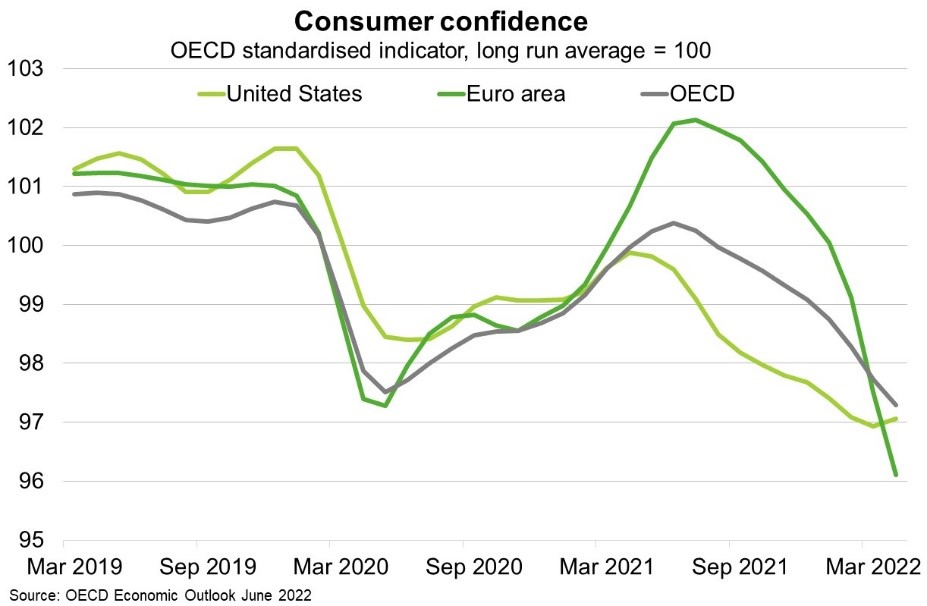

Surging inflation and aggressive monetary tightening are stoking concerns about a global downturn and US recession. In OECD economies, GDP growth is now projected to moderate to 2.7% in 2022 and 1.6% in 2023, with the level of output in 2023 around 2% weaker than previously projected. Meanwhile modelling by the New York Fed suggests the probability of a ‘hard landing’ in the US is about 80%. Economy-wide real hourly wage growth is now negative in most OECD economies, squeezing household incomes and depressing consumer confidence (Chart). This will weigh on consumption, despite the strong labour market and robust household balance sheets. Consequently, OECD forecasts for world trade growth have also been revised lower, to about 5% in 2022 and 4% in 2023 (from 10% in 2021). The weaker economic and trade outlook will be an additional challenge for Australian exporters.