World—Red Sea hostilities raise risk of inflationary trade bottlenecks

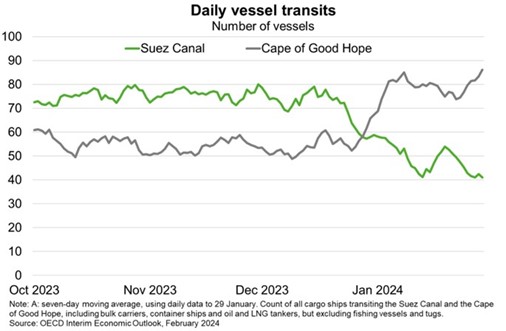

Militant attacks on commercial vessels traversing the Red Sea have disrupted the primary shipping lane connecting Asia to Europe. Sea freight and insurance costs have risen sharply as cargoes are rerouted around the Cape of Good Hope (Chart), which increases journey times by between 30-50%. Assuming the conflict is contained, the strong supply of container ships coming into the market after the pandemic, alongside weaker demand for goods, should help to keep cost pressures in check and reduce the effects on the global economy. Indeed, the New York Fed’s Global Supply Chain Pressure Index is trending upward but remained close to its historical average in January. Furthermore, transport represents only a small share of overall input costs for the European manufacturers that are disproportionately impacted. Nonetheless, OECD research suggests that the recent 100% increase in shipping costs, if persistent, could add 0.4 percentage points to consumer price inflation after about a year.

The situation remains volatile. An escalation of hostilities could drive up global commodity prices and renew inflationary pressures. The Middle East produces about 35% of global oil exports and 13% of natural gas exports. Oil prices are forecast to edge down this year assuming no escalation of hostilities; amid higher supply from non-OPEC+ countries and increased global energy efficiency and electrification. However, Institute of International Finance (IIF) modelling shows that potential disruption to energy shipping in the Strait of Hormuz and continued attacks on cargo ships could result in a 40% increase in oil and gas prices and much lower global trade in 2024. This creates inflationary pressures at a time when inflation in most advanced economies remains above target. The IIF estimate this scenario has a 30% probability and would lower global growth by 0.4 percentage points relative to the baseline scenario.