World—Multiple economic headwinds raise recession risk

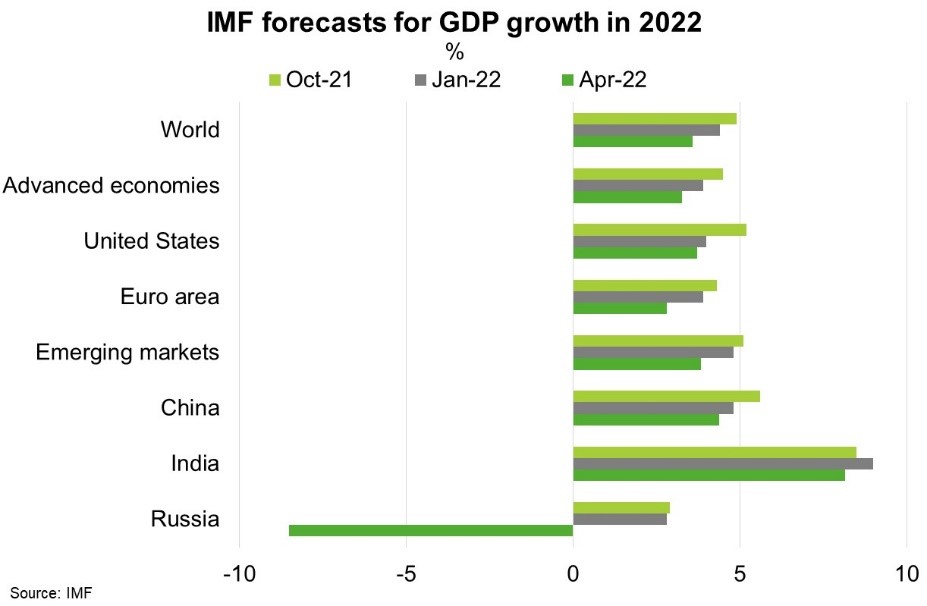

The IMF forecast global growth to slow from 6.1% in 2021 to 3.6% in 2022 and 2023. This is 0.8 ppts lower than projected in January for 2022 (Chart). The downgrade largely reflects an 11.3 ppt cut in GDP for Russia, a 1.1 ppt cut for the euro area, and other economic global spillovers due to Russia’s invasion of Ukraine. Several major economies—France, Germany, Italy and the UK—are projected to barely expand or even contract for two straight quarters this year. With few exceptions, the IMF expect global employment and output to remain below pre-pandemic trends through 2026. These forecasts assume the conflict remains confined to Ukraine, further sanctions on Russia exempt the energy sector, the economic and health impacts of the pandemic abate over 2022, and there are no major financial crises.

Multiple shocks have increased the risk of global recession. First, Russia’s invasion of Ukraine is a supply shock that will exacerbate price pressures and slow economic growth, via weaker business investment and consumer spending. Second, the highly disruptive Omicron wave in China will weaken growth and worsen supply chain disruptions. China’s industrial production fell by 2.9% from a year earlier in April, while retail sales fell by 11%. The new export orders index also fell sharply in April, suggesting one of the few bright spots in China’s economy is weakening. Last, a tightening in US financial conditions poses a risk to global economic stability, weighing particularly on emerging markets, with the rise in real long term US interest rates now comparable to the 2013 taper tantrum.

Several factors could change this outlook. For instance, inflation expectations may drift away from central bank inflation targets, higher prices may stoke social unrest in poorer countries due to higher costs of living, or the world economy may see more entrenched geopolitical blocks, all of which challenge economic growth and raise financial market volatility.