Emerging Markets—Tight financial conditions dent economic prospects

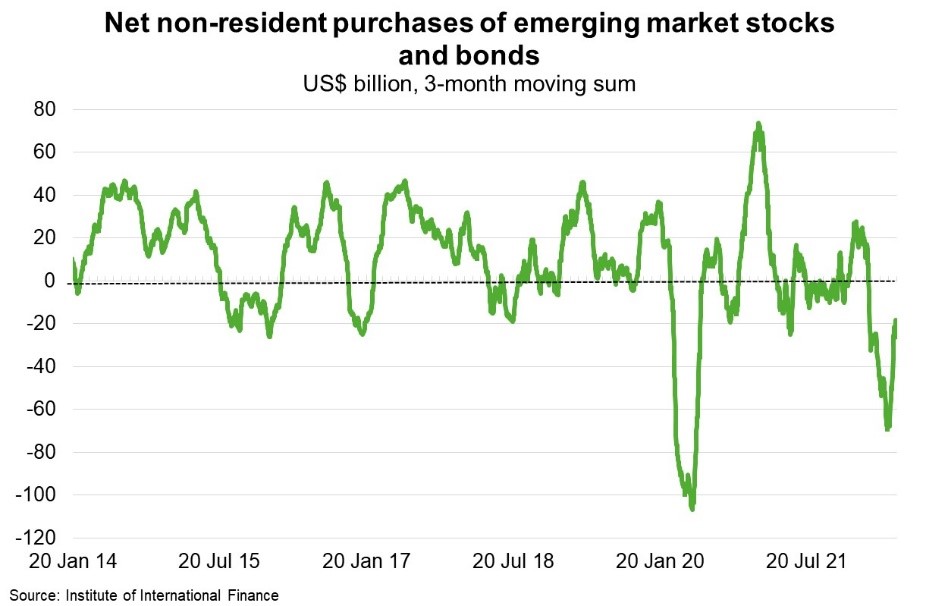

Investors’ concerns about accelerating inflation and slowing global growth has created significant financial turbulence in recent weeks. Capital flows are shifting from emerging markets (EMs) to advanced economies, where interest rates are rising sharply (particularly in the US). Outflows from EM bonds and stocks is comparable in scale to 2015-16, according to the Institute of International Finance (Chart). This is all contributing to tighter financial conditions in EMs, as domestic and foreign-currency interest rates rise, currencies depreciate, stocks and bond markets decline and access to external financing diminishes.

Tighter financing conditions weigh on economic prospects and raise financial stability risks. That’s because rising financing costs hamper the debt servicing ability of financially stressed firms and weigh on foreign and domestic investment. In emerging markets where interest rates increase, household debt service burdens will rise, which together with elevated inflation, will erode households’ purchasing power. Depreciating EM currencies will increase import bills and raise the cost of servicing foreign currency debts for banks, corporates and governments, which added significant debt during the pandemic. For many EM government’s reliant on external financing, lower access to, and rising costs of, US dollar financing puts a drain on public finances—leaving less room for much-needed spending on physical and social infrastructure. The currencies of Turkey, Argentina, Egypt, Pakistan, Ghana and Hungary have seen relatively large depreciations against the US dollar in 2022. These factors also contributed to Sri Lanka’s sovereign debt default earlier this year and have heightened financial stability risks in Laos.

Economic and financial challenges in EMs adds downside risks to Australian exports, given EMs accounted for roughly 55% of all Australian exports in 2020 (of which China represented about 37%).